|

|

|

Промышленный лизинг

Методички

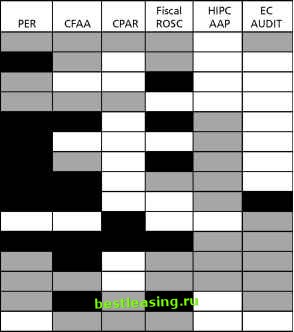

Scope and coverage of external financial reports Timeliness and quality of external financial reports Records management systems Debt and aid management Debt and aid management laws and regulations Management, control, and reporting of government debt Management, control, and reporting of financial assets Management, control, and reporting of aid External audit Legal framework for external audit Independence of supreme audit institution Jurisdiction of supreme audit institution Audit standards Timeliness and quality of audit reports Sanctions for irregularity Legislative review of audit reports Follow-up on audit recommendations Administrative and financial management capacity Personnel quality, capacity, incentives, and management The methodology gives an overview of the coverage and is thus useful in signaling possible gaps or overlaps in the scope and coverage of the instruments. However, as noted earlier, for each of the 94 subcomponents a binary choice must made - coverage or no coverage. From such choice little can be inferred regarding the depth or relevance of the analysis - let alone its quality. Therefore, the study supplemented the mapping exercise by collecting information from reports, reviews, and other sources from a number of countries where the instruments have been applied.1 Most important for judgments about the quality of the assessment, interviews were conducted with staff from the World Bank, IMF and other agencies and, to a more limited degree, government officials. Although still largely anecdotal and partial, this information complements the mapping of coverage and underpins the find- Component Legal framework for expenditure management Intergovernmental fiscal relations Relations between government and nongovernment entities Government structure Budget coverage Expenditure analysis Fiscal framework and expenditure programming Budget preparation Treasury systems, cash management, and expenditure monitoring Public procurement and management of physical assets Internal control and audit Accounting, reporting, and records management Debt and aid management External audit Personnel quality, capacity, incentives, and management  Key: Level of coverage = Complete or substantial coverage I I = Partial or moderate coverage I I = Little or no coverage ings and recommendations advanced later in this study. A major qualification, however, should be advanced at the outset. Nowhere in the above list of public expenditure management dimensions are the words corruption and governance mentioned. This is not an oversight. The risk of corruption, i.e., the misuse of public power for private gain, pervades every aspect of the public expenditure management cycle and cannot be handled as an item on a checklist. Recalling the earlier discussion on risk, corruption affects the very first component of fiduciary risk, namely, that the money provided for approved budgetary purposes ends up instead in private pockets. If the funds disappear, analyses of their allocation and efficient use are instantly irrelevant. Although a substantive discussion of corruption is outside the scope of this study, 2 public expenditure (and especially public investment), is known to offer some of the best opportunities for corruption, and not only in the procurement phase. As in other areas, while enforcement through internal control and other means is helpful, the most effective ways to combat corruption is to reduce the opportunities and incentives for it - normally arising from over complex and opaque regulations - and to strengthen transparency and oversight mechanisms. The struggle against corruption must therefore be conducted by closing off corruption opportunities, through concrete improvements in specific aspects and procedures of public expenditure management. Most concrete improvements in one or another public expenditure management component tend to have, among other benefits, a positive impact in terms of reducing corruption. This explains why, although corruption does not appear as a separate item for assessment, the issue of financial integrity underpins almost every one of the components listed earlier. Ideally, diagnostic reviews should go through each phase of the budget cycle to identify areas that are vulnerable to corruption, and recommend ways in which corruption risks can be addressed in the area concerned. For example, during budget formulation, hard budget constraints can be evaded by the use of Build-Operate-Transfer (BOT) mechanisms, which in turn can easily become a vehicle for hiding illicit transactions. During budget execution, corruption risks can be reduced by improving the procedures for award of large procurement contracts. And so on. Also conspicuous for their absence from the mapping are the four pillars of governance - accountability, transparency, rule of law and participation. As in the case of corruption, however, this absence is only apparent. The four pillars of governance should be seen as guiding principles for the public expenditure management assessment, providing a prism through which 1 2 3 4 5 6 7 8 9 10 11 12 13 14 [ 15 ] 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 |