|

|

|

Промышленный лизинг

Методички

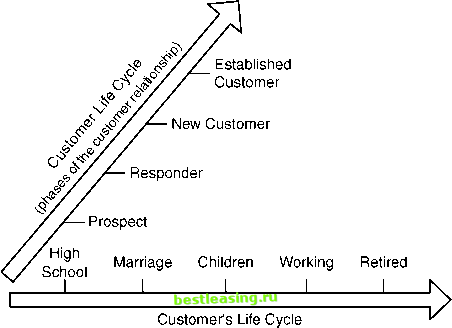

Mass intimacy also brings up the issue of privacy, which has become a major concern with the growth of the Web. To the extent that we are studying customer behavior, the data sources are the transactions between the customer and the company-data that companies typically can use for business purposes such as CRM (although there are some legal exceptions even to this). The larger concern is when companies sell information about individuals. Although such data may be useful when purchased, or may be a valuable source of revenue, it is not a necessary part of data mining. In-between Relationships The in-between relationship is perhaps the most challenging. These are the customers who are not big enough to warrant their own account teams, but are big enough to require specialized products and services. These may be small and medium-sized businesses. However, there are other groups, such as so-called mass affluent banking customers, who do not have quite enough assets to merit private banking yet who still do want special attention. These customers often have a wider array of products, or at least of pricing mechanisms-discounts for volume purchases, and so on-than mass intimacy customers. They also have more intense customer service demands, having dedicated call centers and Web sites. There are often account specialists who are responsible for dozens or hundreds of these relationships at the same time. These specialists do not always give equal attention to all customers. One use of data mining is in spreading best practices-finding what has been working and has not been working and spreading this information. When there are tens of thousands of customers, it is also possible to use data mining directly to find patterns that distinguish good customers from bad, and for determining the next product to sell to a particular customer. This use is very similar to the mass intimacy case. Indirect Relationships Indirect relationships are another type of customer relationship, where intermediate agents broker the relationship with end users. For instance, insurance companies sell their products through agents, and it is often the agent that builds the relationship with the customer. Some are captive agents that only sell one companys policies; others offer an assortment of products from different companies. Such agent relationships pose a business challenge. For instance, an insurance company once approached Data Miners, Inc. to build a model to determine which policyholders were likely to cancel their policies. Before starting the project, the company realized what would happen if such a model were put in place. Armed with this information, agents would switch high-risk policyholders to other carriers-accelerating the loss of these accounts rather than preventing it. This company did not go ahead with the project. Perhaps part of the problem was a lack of imagination in figuring out appropriate interventions. The company could have provided special incentives to agents to keep customers who were at risk-a win-win situation for everyone involved. In such agent-based relationships, data mining can be used not only to understand customers but also to understand agents. Indirection occurs in other areas as well. For instance, mutual fund companies sell retirement plans through employers. The first challenge is getting the employer to include the funds in the plan. The second is getting employees to sign up for the right funds. Ditto for many health care plans at large companies in the United States. Product manufacturers have a similar problem. Telephone handset manufacturers such as Motorola, Nokia, and Ericsson, would like to develop a loyal customer base, so customers continue to return to them handset after handset. Automobile manufacturers have similar goals. Pharmaceutical companies have traditionally marketed to the doctors who prescribe drugs rather then the people who use them, although drugs such as Viagra are now also being marketed to consumers. Another good example of a campaign for a product sold indirectly is the Intel Inside campaign on personal computers-a mark of quality meant to build brand loyalty for a chip that few computer users ever actually see. However, Intel has precious little information on the people and companies whose desktops are adorned with their logo. Customer Life Cycle When thinking about customers, it is easy to think of them as static, unchanging entities that compose the market. However, this is not really accurate. Customers are people (or organizations of people), and they change over time. Understanding these changes is an important part of the value of data mining. These changes are called the customer life cycle. In fact, there are two customer life cycles of interest, as shown in Figure 14.2. The first are life stages. For an individual, this refers to life events, such as graduating from high school, having kids, getting a job, and so on. For a business customer, the life cycle often refers to the size or maturity of the business. The second customer life cycle is the life cycle of the relationship itself. These two life cycles are fairly independent of each other, and both are very important for business.  (phases in the lifetimes of customers) Figure 14.2 There are two customer life cycles. The Customers Life Cycle: Life Stages The customers life cycle consists of events external to the customer relationship that represent milestones in the life of each individual customer. These milestones consist of events large and small, familiar to everyone. The perspective of the customers life stages is useful because people-even business people-understand these events and how they affect individual customers. For instance, moving is a significant event. When people move, they often purchase new furniture, subscribe to the local paper, open a new bank account, and so on. Knowing who is moving is useful for targeting such individuals, especially for furniture dealers, newspapers, and banks (among others). This is true for many other life events as well, from graduating from high school and college, to getting married, having children, changing jobs, retiring, and so on. Understanding these life stages enables companies to define products and messages that resonate with particular groups of people. For a small business, this is not a problem. A wedding gown shop specializes in wedding gowns; such a business grows not because women get married more often, but through recommendations. Similarly, moving companies do not need to encourage their recent customers to relocate; they need to bring in new customers. 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53 54 55 56 57 58 59 60 61 62 63 64 65 66 67 68 69 70 71 72 73 74 75 76 77 78 79 80 81 82 83 84 85 86 87 88 89 90 91 92 93 94 95 96 97 98 99 100 101 102 103 104 105 106 107 108 109 110 111 112 113 114 115 116 117 118 119 120 121 122 123 124 125 126 127 128 129 130 131 132 133 134 135 136 137 138 139 140 141 142 143 144 145 146 147 148 149 150 151 152 153 154 155 156 157 158 [ 159 ] 160 161 162 163 164 165 166 167 168 169 170 171 172 173 174 175 176 177 178 179 180 181 182 183 184 185 186 187 188 189 190 191 192 193 194 195 196 197 198 199 200 201 202 203 204 205 206 207 208 209 210 211 212 213 214 215 216 217 218 219 220 221 222 |