|

|

|

Промышленный лизинг

Методички

Sometimes, event-based relationships imply a business-to-business relationship with an intermediary. Once again, pharmaceutical companies provide an example, since much of their marketing budget is spent on medical providers, encouraging them to prescribe certain drugs. Subscription-Based Relationships Subscription-based relationships provide more natural opportunities to understand customers. In the list given earlier, the last three examples all have ongoing billing relationships where customers have agreed to pay for a service over time. A subscription relationship offers the opportunity for future cash flow (the stream of future customer payments) and many opportunities for interacting with each customer. For the purposes of this discussion, subscription-based relationships are those where there is a continuous relationship with a customer over time. This may take the form of a billing relationship, but it also might take the form of a retailing affinity card or a registration at a Web site. In some cases, the billing relationship is a subscription of some sort, which leaves little room to up-sell or cross-sell. So, a customer who has subscribed to a magazine may have little opportunity for an expanded relationship. Of course, there is some opportunity. The magazine customer could purchase a gift subscription or buy branded products. However, the future cash flow is pretty much determined by the current composition of products. In other cases, the ongoing relationship is just a beginning. A credit card may send a bill every month; however, nothing charged, nothing owed. A long-distance provider may charge a customer every month, but it may only be for the monthly minimum. A cataloger sends catalogs to customers, but most will not make a purchase. In such cases, usage stimulation is an important part of the relationship. Subscription-based relationships have two key events-the beginning and end of the relationship. When these events are well defined, then survival analysis (Chapter 12) is a good candidate for understanding the duration of the relationship. However, sometimes defining the end of the relationship is difficult: A credit card relationship may end when a customer has no balance and has made no transactions for a specified period of time (such as 3 months or 6 months). A catalog relationship may end when a customer has not purchased from the catalog in a specified period of time (such as 18 months). An affinity card relationship may end when a customer has not used the card for a specified period of time (such as 12 months). Even when the relationship is quite well understood, there may be some tricky situations. Should the end date of the relationship be the date of customer contact or the date the account is closed? Should customers who fail to pay their last bill be considered the same as customers who were stopped for nonpayment? These situations are meant as guidelines for understanding the customer relationship. It is worthwhile to map out the different stages of customer interactions. Figure 14.4 shows different elements of customer experience for newspaper subscription customers. These customers basically have the following types of interactions: Starting the subscription via some channel Changing the product (weekday to 7-day, weekend to 7-day, 7-day to weekday, 7-day to weekend) Suspending delivery (typically for a vacation) Complaining Stopping the subscription (either voluntarily or forced) In a subscription-based relationship, it is possible to understand the customer over time, gathering all these disparate types of events into a single picture of the customer relationship. Stop Temporarily

Stop Temporarily Complain

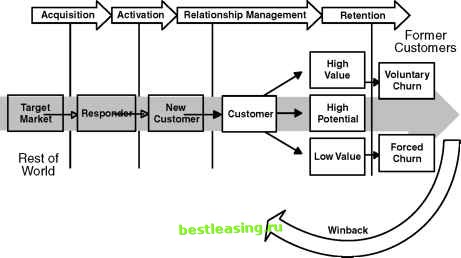

Complain Figure 14.4 (Simplified) customer experience for newspaper subscribers includes several different types of interactions. h an Business Processes Are Organized around the Customer Life Cycle The customer life cycle describes customers in terms of the length and depth of their relationship. Business processes move customers from one phase of the life cycle to the next, as shown in Figure 14.5. Looking at these business processes is valuable, because this is precisely what businesses want to do: make customers more valuable over time. In this section, we look at these different processes and the role that data mining plays in them. Customer Acquisition Customer acquisition is the process of attracting prospects and turning them into customers. This is often done by advertising and word of mouth, as well as by targeted marketing. Data mining can and does play an important role in acquisition. Chapter 5, for instance, has an interesting example of using expected values derived from chi-square to highlight differences in acquisition among different regions. Such descriptive analyses can suggest best practices to spread through different regions. There are three important questions with regards to acquisition, which are investigated in this section: Who are the prospects? When is a customer acquired? What is the role of data mining?  Figure 14.5 Business processes are organized around the customer life cycle. 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53 54 55 56 57 58 59 60 61 62 63 64 65 66 67 68 69 70 71 72 73 74 75 76 77 78 79 80 81 82 83 84 85 86 87 88 89 90 91 92 93 94 95 96 97 98 99 100 101 102 103 104 105 106 107 108 109 110 111 112 113 114 115 116 117 118 119 120 121 122 123 124 125 126 127 128 129 130 131 132 133 134 135 136 137 138 139 140 141 142 143 144 145 146 147 148 149 150 151 152 153 154 155 156 157 158 159 160 [ 161 ] 162 163 164 165 166 167 168 169 170 171 172 173 174 175 176 177 178 179 180 181 182 183 184 185 186 187 188 189 190 191 192 193 194 195 196 197 198 199 200 201 202 203 204 205 206 207 208 209 210 211 212 213 214 215 216 217 218 219 220 221 222 |

|||||||||||||||||||||||||||||||||||||