|

|

|

Промышленный лизинг

Методички

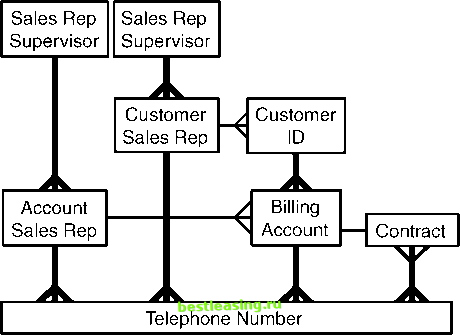

Constructing the Customer Signature Building the customer signature, especially the first time, is a very incremental process. At a minimum, customer signatures need to be built at least two times-once for building the model and once for scoring it. In practice, exploring data and building models suggests new variables and transformations, so the process is repeated many times. Having a repeatable process simplifies the data mining work. The first step in the process, shown in Figure 17.7, is to identify the available sources of data. After all, the customer signature is a summary, at the customer level, of what is known about each customer. The summary is based on available data. This data may reside in a data warehouse. It might equally well reside in operational systems and some might be provided by outside vendors. When doing predictive modeling, it is particularly important to identify where the target variable is coming from. The second step is identifying the customer. In some cases, the customer is at the account level. In others, the customer is at the individual or household level. In some cases, the signature may have nothing to do with a person at all. We have used signatures for understanding products, zip codes, and counties, for instance, although the most common use is for accounts and households. I 111 II i i 11111 и i и i i 1111 i и i и I I 1111 11 11 l l 11111 11 Identify a working definition of customer. Copy most recent I 111 I I 11111 I I I 1111 I III II I I 1111 III III I I 11111 11 input data snapshot of customer. Pivot to produce I 111 I I 11111 II I II I I 1111 I III II I I 1111 III III I I 11111 11 multiple months of data for some data elements. IIIIH i i iiiiiHiH i i Минин i i llllllllll l l 11111 i [Calculate churn flag 11111 II I II I I 1111 I III II I I 1111 III III I I 11111 I for the prediction period. I 111 II j j 11111 i i i 1111 i i i i llllllllll l l 11111 11 Revisit the customer IIHH I I МИНИН I I llllllllll I I МИНИН I I 11111 I definition. I HI II i i iiiiiiiiii i i iiiiiiiin i i пинии i i 11111 i incorporate other I 111 II I I 11111 II I II I I 1111 I III II I I llllllllll I I 11111 I Idata sources. I 111 I I 11111 II I II I I 1111 I III II I I llllllllll I I 11111 11 Add derived variables. Figure 17.7 Building customer signatures is an iterative process; start small and work through the process step-by-step, as in this example for building a customer signature for churn prediction. Once the customer has been identified, data sources need to be mapped to the customer level. This may require additional lookup tables-for instance, to convert accounts into households. It may not be possible to find the customers in the available data. Such a situation requires revisiting the customer definition. The key to building customer signatures is to start simple and build up. Prioritize the data sources by the ease with which they map to the customer. Start with the easiest one, and build the signature using it. You can use a signature before all the data is put into it. While awaiting more complicated data transformations, get your feet wet and understand what is available. When building customer signatures out of transactions, be sure to get all the transactions associated with a particular customer. Cataloging the Data The data mining group at a mobile telecommunications company wants to develop a churn model in-house. This churn model will predict churn for one month, given a one-month lag time. So, if the data is available for February, then the churn prediction is for April. Such a model provides time for gathering the data and scoring new customers, since the February data is available sometime in March. At this company, there are several potential sources of data for the customer signatures. All of these are kept in a data repository with 18 months of history. Each file is an end-of-the-month snapshot-basically a dump of an operational system into a data repository. The UNIT MASTER file contains a description of every telephone number in service and a snapshot of what is known about the telephone number at the end of the month. Examples of fields in this file are the telephone number, billing account, billing plan, handset model, last billed date, and last payment. The TRANS MASTER file contains every transaction that occurs on a particular telephone number during the course of the month. These are account-level transactions, which include connections, disconnections, handset upgrades, and so on. The BILL MASTER file describes billing information at the account level. Multiple handsets might be attached to the same billing account-particularly for business customers and customers on family billing plans. Although other sources of data were available in the company, these were not immediately highlighted for use for the customer signature. One source, for instance, was the call detail records-a record of every telephone call-that is useful for predicting churn. Although this data was eventually used by the data mining group, it was not part of this initial effort. Identifying the Customer The data is typical of the real world. Although the focus might be on one type of customer or another, the data has multiple groups. The sidebar Residential Versus Business Customers talks about distinguishing between these two segments. The business problem being addressed in this example is churn. As shown in Figure 17.8, the customer data model is rather complex, resulting in different options for the definition of customer: Telephone number Customer ID Billing account This being the real world, though, it is important to remember that these relationships are complex and change over time. Customers might change their telephone numbers. Telephones might be added or removed from accounts. Customers change handsets, and so on. For the purposes of building the signature, the decision was to use the telephone number, because this was how the business reported churn.  Figure 17.8 The customer model is complicated and takes into account sales, billing, and business hierarchy information. 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53 54 55 56 57 58 59 60 61 62 63 64 65 66 67 68 69 70 71 72 73 74 75 76 77 78 79 80 81 82 83 84 85 86 87 88 89 90 91 92 93 94 95 96 97 98 99 100 101 102 103 104 105 106 107 108 109 110 111 112 113 114 115 116 117 118 119 120 121 122 123 124 125 126 127 128 129 130 131 132 133 134 135 136 137 138 139 140 141 142 143 144 145 146 147 148 149 150 151 152 153 154 155 156 157 158 159 160 161 162 163 164 165 166 167 168 169 170 171 172 173 174 175 176 177 178 179 180 181 182 183 184 185 186 187 188 189 190 191 192 193 [ 194 ] 195 196 197 198 199 200 201 202 203 204 205 206 207 208 209 210 211 212 213 214 215 216 217 218 219 220 221 222 |