|

|

|

Промышленный лизинг

Методички

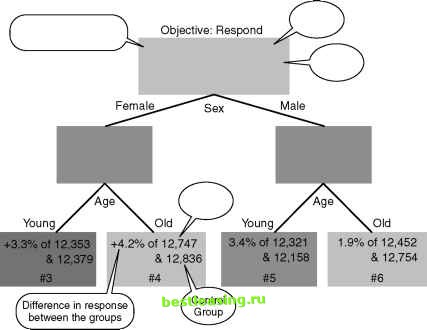

Figure 4.5 Quadstones differential response tree tries to maximize the difference in response between the treated group and a control group. Using Current Customers to Learn About Prospects A good way to find good prospects is to look in the same places that todays best customers came from. That means having some of way of determining who the best customers are today. It also means keeping a record of how current customers were acquired and what they looked like at the time of acquisition. Of course, the danger of relying on current customers to learn where to look for prospects is that the current customers reflect past marketing decisions. Studying current customers will not suggest looking for new prospects anyplace that hasnt already been tried. Nevertheless, the performance of current customers is a great way to evaluate the existing acquisition channels. For prospecting purposes, it is important to know what current customers looked like back when they were prospects themselves. Ideally you should: Start tracking customers before they become customers. Gather information from new customers at the time they are acquired. Model the relationship between acquisition-time data and future outcomes of interest. The following sections provide some elaboration. Start Tracking Customers before They Become Customers It is a good idea to start recording information about prospects even before they become customers. Web sites can accomplish this by issuing a cookie each time a visitor is seen for the first time and starting an anonymous profile that remembers what the visitor did. When the visitor returns (using the same browser on the same computer), the cookie is recognized and the profile is updated. When the visitor eventually becomes a customer or registered user, the activity that led up to that transition becomes part of the customer record. Tracking responses and responders is good practice in the offline world as well. The first critical piece of information to record is the fact that the prospect responded at all. Data describing who responded and who did not is a necessary ingredient of future response models. Whenever possible, the response data should also include the marketing action that stimulated the response, the channel through which the response was captured, and when the response came in. Determining which of many marketing messages stimulated the response can be tricky. In some cases, it may not even be possible. To make the job easier, response forms and catalogs include identifying codes. Web site visits capture the referring link. Even advertising campaigns can be distinguished by using different telephone numbers, post office boxes, or Web addresses. Depending on the nature of the product or service, responders may be required to provide additional information on an application or enrollment form. If the service involves an extension of credit, credit bureau information may be requested. Information collected at the beginning of the customer relationship ranges from nothing at all to the complete medical examination sometimes required for a life insurance policy. Most companies are somewhere in between. Gather Information from New Customers When a prospect first becomes a customer, there is a golden opportunity to gather more information. Before the transformation from prospect to customer, any data about prospects tends to be geographic and demographic. Purchased lists are unlikely to provide anything beyond name, contact information, and list source. When an address is available, it is possible to infer other things about prospects based on characteristics of their neighborhoods. Name and address together can be used to purchase household-level information about prospects from providers of marketing data. This sort of data is useful for targeting broad, general segments such as young mothers or urban teenagers but is not detailed enough to form the basis of an individualized customer relationship. Among the most useful fields that can be collected for future data mining are the initial purchase date, initial acquisition channel, offer responded to, initial product, initial credit score, time to respond, and geographic location. We have found these fields to be predictive a wide range of outcomes of interest such as expected duration of the relationship, bad debt, and additional purchases. These initial values should be maintained as is, rather than being overwritten with new values as the customer relationship develops. Acquisition-Time Variables Can Predict Future Outcomes By recording everything that was known about a customer at the time of acquisition and then tracking customers over time, businesses can use data mining to relate acquisition-time variables to future outcomes such as customer longevity, customer value, and default risk. This information can then be used to guide marketing efforts by focusing on the channels and messages that produce the best results. For example, the survival analysis techniques described in Chapter 12 can be used to establish the mean customer lifetime for each channel. It is not uncommon to discover that some channels yield customers that last twice as long as the customers from other channels. Assuming that a customers value per month can be estimated, this translates into an actual dollar figure for how much more valuable a typical channel A customer is than a typical channel B customer-a figure that is as valuable as the cost-per-response measures often used to rate channels. Data Mining for Customer Relationship Management Customer relationship management naturally focuses on established customers. Happily, established customers are the richest source of data for mining. Best of all, the data generated by established customers reflects their actual individual behavior. Does the customer pay bills on time? Check or credit card? When was the last purchase? What product was purchased? How much did it cost? How many times has the customer called customer service? How many times have we called the customer? What shipping method does the customer use most often? How many times has the customer returned a purchase? This kind of behavioral data can be used to evaluate customers potential value, assess the risk that they will end the relationship, assess the risk that they will stop paying their bills, and anticipate their future needs. Matching Campaigns to Customers The same response model scores that are used to optimize the budget for a mailing to prospects are even more useful with existing customers where they 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 [ 44 ] 45 46 47 48 49 50 51 52 53 54 55 56 57 58 59 60 61 62 63 64 65 66 67 68 69 70 71 72 73 74 75 76 77 78 79 80 81 82 83 84 85 86 87 88 89 90 91 92 93 94 95 96 97 98 99 100 101 102 103 104 105 106 107 108 109 110 111 112 113 114 115 116 117 118 119 120 121 122 123 124 125 126 127 128 129 130 131 132 133 134 135 136 137 138 139 140 141 142 143 144 145 146 147 148 149 150 151 152 153 154 155 156 157 158 159 160 161 162 163 164 165 166 167 168 169 170 171 172 173 174 175 176 177 178 179 180 181 182 183 184 185 186 187 188 189 190 191 192 193 194 195 196 197 198 199 200 201 202 203 204 205 206 207 208 209 210 211 212 213 214 215 216 217 218 219 220 221 222 |