|

|

|

Промышленный лизинг

Методички

debate. Professor Shiller argued (correctly so) that stocks were overvalued in the late 1990s. On the other hand, Professor Siegel has maintained a uniformly positive view of stocks, before, during, and after the bursting of the bubble in 2000. Because of their opposing views on the prospects for stocks, they are often contrasted as leaders of the bear and bull camps. When it comes to the crash of 1987, however, Professors Shiller and Siegel agree. The crash was not caused by any rational factor such as a news event. Professor Shiller summarizes his findings as, No news story or rumor appearing on the 19th or over the preceding weekend was responsible for investor behavior. 8 Similarly, Professor Siegel writes, No economic event on or about October 19,1987 can explain the record collapse of equity prices. 9 As most of us know all too well, starting in 2000 the NASDAQ suffered a decline that was less dramatic than the 1987 crash, but more severe and longer lasting. Table 3.1 shows the performance of leading stocks sometimes called the four new horsemen of the NASDAQ. These figures suggest that either precrash prices were irrationally high or postcrash prices irrationally low. When Cisco was priced at $80, the evidence suggests that the stock price was irrationally high. Similarly, when Cisco was trading at $8, after the bubble burst, the evidence suggests that the stock price was irrationally low. The Denial: The believers in the efficient markets hypothesis deny that sudden price changes indicate irrationality. Furthermore, they claim that TABLE 3.1 The Decline and Partial Recovery of the Four New Horsemen of the NASDAQ Bubble peak (2000) Post-bubble low Current (7/2004)

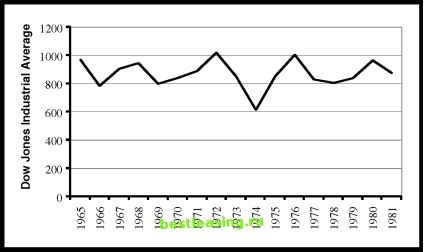

Source: The Wall Street Journal Ciscos stock price (and all other prices) were correct at the time. Thus, they argue that the decline in Ciscos price from $80 to $8 was caused by unexpected information that was unknowable at the peak. This claim is based on the fact that stocks discount the future. For example, the value of Cisco in 2000 depends on Chinas attitude toward imports in 2010, so even small changes in investors expectations about Chinas future import policy can cause big changes in Ciscos value. Even huge price changes can be rational when nothing concrete changes in the world. Thus, even though Professors Shiller and Siegel cannot identify the cause of the 1987 crash, it can be explained as a rational response to expectations about the future. Since we cant know what those expectations are, we cant conclude that the sudden changes in stock prices are irrational. Photographic Evidence: Asset Bubbles in the Laboratory In the real world, we can never prove that bubbles and crashes are caused by irrationality. It is possible that real world crashes are caused by changes in unknowable variables. To investigate bubbles, economists have built artificial stock markets where everything is known. In these laboratory markets, bubbles and crashes, if they exist, must come from inside people. In fact, Professor Vernon Smith and others have found that even artificial stock markets exhibit bubbles and crashes. In these experiments, people trade a stock for real money. In contrast to the actual stock market, the traders in these artificial markets know the true value of the stock. Nevertheless, traders in these artificial markets push stock prices up to irrationally high prices and then the prices crash.10 In the artificial markets, there is no explanation for the bubbles and crashes other than the fact that they arise naturally as part of human nature. True rational market believers argue that the markets are artificial and, in the real world, people who trade at irrational prices would be weeded out. It wasnt me. Claim #2: Markets Are More Than Simply Irrational-They Can Be Mean Investors seem to have an uncanny ability to be wrong about investments. We tend to be optimistic about stocks just before market collapses and pessimistic just before bull markets. Consider the experience of U.S. investors in the period from 1965 to 1981 as shown in Figure 3.1. The Dow Jones Industrial Average ended 1965 at 969, and 16 years later the index stood at 875. Almost an entire generation passed with the stock market going absolutely nowhere. Near the end of this period, people essentially forgot about stocks, and in 1980 only 5.7% of households owned any mutual funds.11 In 1979, BusinessWeek printed its now infamous Death of Equities  FIGURE 3.1 A Generation without Stock Market Gains Source: Dow Jones 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 [ 16 ] 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53 54 55 56 57 58 59 60 61 62 63 64 65 66 67 68 69 70 71 72 73 74 75 76 77 78 79 80 81 82 83 84 85 86 87 88 89 90 91 92 93 94 95 96 97 98 99 100 101 102 103 104 105 |