|

|

|

Промышленный лизинг

Методички

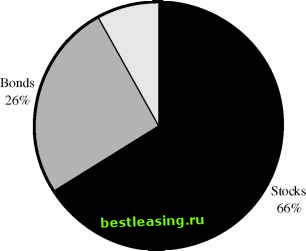

chapter one INTRODUCTION Mean Markets and Lizard Brains Where Should We Invest Our Money? Where should I invest my money? So asked Adam, a former Harvard Business School student of mine. Soon after getting his MBA, Adam was working as an investment banker. His detailed knowledge of debt-laden companies had made him a bit gloomy about the economic situation. After hearing Adams views, I asked where he had invested his money. Given his dour outlook, I expressed surprise when Adam said he had 60% of his wealth invested in stocks. In response to my shocked look, he asked for my advice. Clearly Adam thought he was being conservative with only 60% of his wealth in stocks. Hasnt it been proven-over hundreds of years-that stocks provide the greatest long-term return? Shouldnt a patient investor, particularly a young one, put almost everything in stocks? Maybe. Maybe not. Conventional approaches to answering Adams question are based on the old-school assumption that people are cool-headed decision makers and that financial markets are rational. Recently, a new school has arisen that embraces hot-blooded human emotions as a core feature of our world. The reality is that financial markets have always oscillated between manias and panics, but people have not been terrifically adept at identifying them in advance. The new science of irrationality provides a novel way to model the future and offers investors powerful tools for growing and protecting their wealth. Moving beyond simply describing financial irrationality, we find an underlying logic for costly behavior in what I label the lizard brain - an ancient, often unconscious thought process that exerts a powerful influence on us. This lizard brain has helped us reproduce, find food, and flourish, but it tends not to work so well when dealing with financial markets. The result? Mean markets that wreak havoc with our finances. We will use the new science of irrationality and an understanding of the lizard brain to evaluate bonds, stocks, and real estate. We will find that the current situation is almost a perfect storm designed to frustrate our financial plans, and this will lead to surprising answers to Adams question. In addition to learning where to invest, we will produce novel suggestions on how to invest. Beyond simply making more money, a goal of Mean Markets and Lizard Brains is to increase confidence and reduce financial stress. The Conventional Wisdom: Bonds Are for Wimps Adam works for a famous Wall Street investment bank. If he were to look to Wall Street for guidance on where to invest, he would find some simple advice. Buy stocks. Figure 1.1 shows the consensus of the leading Wall Street investment firms. Wall Street says to invest the bulk of our money into stocks. In addition, economists trumpet the high return on stocks. ( Bonds are for wimps is a quotation of Harvard Professor Greg Mankiw, head of President Bushs Council of Economic Advisors.1) Those of us who live on Main Street have heard the buy stocks message loudly and clearly. Cash  FIGURE 1.1 Bonds Are for Wimps (Wall Streets Investment Advice) Source: Dow Jones Newswires, Wall Street financial strategists2 While only 5.7% of households owned mutual funds near the stock market bottom in 1980, the figure now sits near an all-time high of 50%.3 Furthermore, the most recent Federal Reserve Survey of Consumer Finances reports that stocks represent 56% of all Americans financial assets-a record high.4 So Adams decision to invest most of his money into stocks reflects both the conventional wisdom and common practice. But should we continue to buy stocks and confidently expect high rates of return? Wax On: The Science of Irrationality In The Karate Kid, Daniel (played by Ralph Macchio) moves to California and earns the hatred of a pack of teenage bullies. In self-defense, he seeks to learn karate from Mr. Miyagi, the apartment custodian. Daniel is 1 [ 2 ] 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53 54 55 56 57 58 59 60 61 62 63 64 65 66 67 68 69 70 71 72 73 74 75 76 77 78 79 80 81 82 83 84 85 86 87 88 89 90 91 92 93 94 95 96 97 98 99 100 101 102 103 104 105 |