|

|

|

Промышленный лизинг

Методички

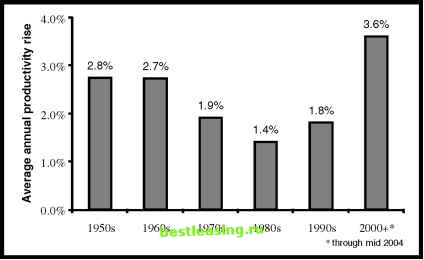

was in 1993. Measured this way, the current federal debt is only about one-half as big now as it was at the end of WWII.8 Conclusion: While the last few years have been painful, there is no proof that the longer-term economic miracle has ended. Bull #2: Vince Lombardi Meets the Computer Winning isnt everything, it is the only thing. This quote is misattributed to legendary Green Bay Packers Coach Vince Lombardi who actually said, Winning is not everything-but making effort to win is. It is an odd quirk of history that Lombardi is most remembered for something he didnt say. What he did say on a variety of topics is great, and much of it is relevant to investing. Among my favorites is, Winning is a habit. Unfortunately, so is losing. When it comes to economic growth, productivity isnt everything, it is the only thing. Even though Coach Lombardi probably never said this either, it is a mathematical fact. There are two roads to wealth: One is to work harder, and the second is to work smarter. Obviously working smarter is the preferred route; productivity measures the economys ability to work smart. Thus productivity becomes the key to long-term economic growth. Optimists can make a good argument based on U.S. productivity as shown in Figure 4.5. This young decade has had higher U.S. productivity growth than any other in the post-WWII era. Is productivity really higher now than in the past and can the good news continue? It seems possible. Some economic historians make an analogy between the Industrial Revolution and the information technology revolution. It took many decades to learn how to harness machines effectively. Thus the benefits from the Industrial Revolution were not immediately visible.  FIGURE 4.5 U.S. Productivity Growth Is Very Rapid Source: U.S. Bureau of Labor Statistics (non-farm business output per hour) We may just be getting to the time when information technology is being understood well enough to make us richer. If so, it is possible that the recent high productivity will not only continue, but could even accelerate. Is the recent rise in productivity really a big deal? Yes, because of the magic of compound interest. My favorite example of compound interest comes from Charles Darwin. In Chapter 3 of the Origin of Species, he writes:9 The elephant is reckoned to be the slowest breeder of all known animals, and I have taken some pains to estimate its probable minimum rate of natural increase: it will be under the mark to assume that it breeds when thirty years old, and goes on breeding till ninety years old, bringing forth three pairs of young in this interval; if this be so, at the end of the fifth century there would be alive fifteen million elephants, descended from the first pair. Darwin was calculating compound interest. If something grows at just over 2.3% a year, it doubles in 30 years. The magic of compound interest means that even with slow rates of growth, given enough time, the overall growth is stunning. The inability of the world to support so many elephants was an important step on Darwins intellectual road. To appreciate what different productivity rates mean, lets take Keynes at his word. What are the economic possibilities of our grandchildren? In particular, lets contrast the wealth of our grandchildren under two possible scenarios. In the high-growth scenario, productivity grows at the 3.62% average of this decade. In the lower-growth scenario, productivity grows at the 1.72% average of the period 1970 to 1999. Does it matter much for your grandchildren which of these two productivity rates exists for the next 40 years? Lets test your intuition. How many hours per week will your grandchild work to have the same lifestyle as could be earned by working 40 hours now? Here are four possible answers. (1) 29.3 hours per week. (2) 20.2 hours per week. (3) 15.9 hours per week. (4) 9.6 hours per week. Pick an answer for each of the two productivity scenarios-high growth and lower growth. If the world turns out as in (2), your grandchildren will be roughly twice as rich as you for each hour that they work. That means twice as many cars, TVs, fridges, and vacations per hour of effort. Before we get to the correct answers, lets take a step back and understand that even a productivity growth rate of 1% is remarkable and rare. What is the productivity growth rate for our closest living ancestor, the chimpanzee? This may seem like a strange question, but the answer is easy to calculate. Take a modern-day chimpanzee, and calculate the number of hours of work to obtain a fixed amount of food. 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 [ 28 ] 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53 54 55 56 57 58 59 60 61 62 63 64 65 66 67 68 69 70 71 72 73 74 75 76 77 78 79 80 81 82 83 84 85 86 87 88 89 90 91 92 93 94 95 96 97 98 99 100 101 102 103 104 105 |