|

|

|

Промышленный лизинг

Методички

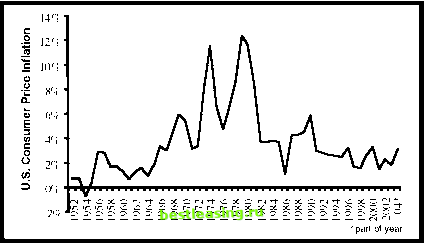

chapter five INFLATION Rising Prices and Shrinking Dollars Return of the Inflationary Monster? During the German hyperinflation of the early 1920s, banknotes had so little value that people had to carry money around in giant sacks. So worthless had the money become that one man who left a wheelbarrow full of money unattended for a moment returned to find that thieves had left his money but had stolen his wheelbarrow. While this story is funny, the hyperinflation itself was not; it wiped out the lifetime savings of millions of families. My first experiences as an investor came in the inflationary 1970s. In those days, inflation was a mysterious monster ravaging the U.S. and global economies. When I was in college in the 1970s, my friends and I used to retire to the student lounge after dinner each night to watch Mel Brooks classic comedy show, Get Smart. Because the lounge had just one shared TV, a form of adolescent democracy selected the channel. Other students who wanted to learn and not laugh sometimes outvoted my friends and me, and on some evenings we were forced to watch the nightly news. When it came to inflation in the 1970s, the TV news was bleak. Every month the government would announce the growing rate of inflation. We sat and feared that we would not have enough money to enjoy life. Even presidents seemed impotent to defeat the inflationary monster. In 1974, President Gerald Ford manufactured millions of WIN buttons to exhort the American public to Whip Inflation Now (although he never told us quite how we were supposed to accomplish this task). In sour economic times, President Ford lost to Jimmy Carter in the 1976 election. President Carter in turn lost his 1980 election to Ronald Reagan-a casualty, some say, in the Federal Reserves campaign to defeat inflation. As shown in Figure 5.1, the 1970s U.S. inflationary monster was tamed, and for the last two decades, the United States has enjoyed a low inflation rate. Stories of inflationary problems might therefore seem to apply only to those living in Latin American countries or those with a long memory. Recently, however, gold prices have risen dramatically,  FIGURE 5.1 The United States Has Enjoyed Low Inflation for Many Years Source: Bureau of Labor Statistics and the value of the U.S. dollar has declined substantially. These are classic signs that inflation might be building. What are the prospects for inflation, and what sorts of financial investments are likely to prosper? As in most areas to do with money, the best insights on inflation come from Professor Milton Friedman. Winner of the 1976 Nobel Prize in Economics, Professor Friedman is the leader of the monetarist school that seeks to understand the financial world through the creation and removal of money from the economy. The seminal work, A Monetary History of the United States, 1867- 1960, written by Professors Friedman and Anna Schwarz, states, Money is a fascinating subject of study because it is so full of mystery and paradox. The piece of green paper with printing on it is little different, as paper, from a piece of the same size torn from a newspaper or magazine, yet the one will enable its bearer to command some measure of food, drink, clothing, and the remaining goods of life: The other is fit only to light the fire. Whence the difference? 1 As Professor Friedman suggests, to understand inflation we must remove some of the monetary mystery. Accordingly, our investigation into inflation starts with an analysis of the reason we use money in its current form. In this journey, we begin by examining a modern market that does not use money at all. The Creation of Money: This Kidney Is Not for Sale! Kidney transplantation is a potentially life-saving surgery that transfers a kidney from one person to another. Sometimes the kidney comes from a donor who has recently died, while many others come from living donors. Most people are born with two kidneys but can live quite well with just one. My Harvard Business School colleague, Professor Al Roth, has become involved in improving the kidney transplantation system. At first 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 [ 30 ] 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53 54 55 56 57 58 59 60 61 62 63 64 65 66 67 68 69 70 71 72 73 74 75 76 77 78 79 80 81 82 83 84 85 86 87 88 89 90 91 92 93 94 95 96 97 98 99 100 101 102 103 104 105 |