|

|

|

Промышленный лизинг

Методички

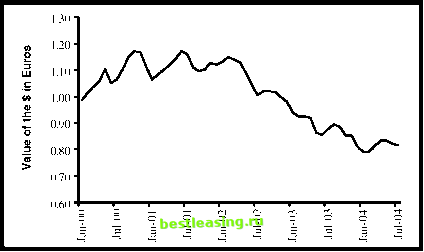

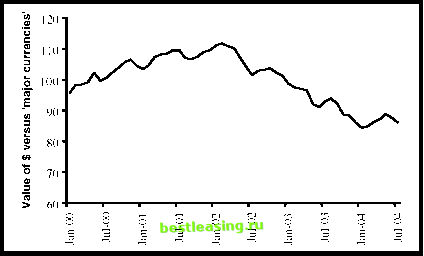

dollars can be created by the United States at no cost, the same would be true if the U.S. debt totaled $35 trillion or $350 trillion. So we still havent figured out why anyone would be worried about the United States debt to the world. In an early scene in Waterworld, Kevin Costner enters a community in search of trade. Costner offers to sell some dirt, a precious resource to a floating world that needs to grow plants. In return for his dirt, Costner is offered money and after some haggling, a deal is reached. When he goes to buy something with his money, however, Costner is angered to find that the amount that he has just earned is too little to buy anything useful. Hey, Ill give you 16 quadtrillion credits for your car. Is that a good price? Obviously it depends on what real goods you can buy with a credit. Costners behavior makes no sense. Haggling over price only makes sense if the money has known value. Similarly, the people who have lent the United States money do not need to fear default. They will get whatever amount of dollars they are owed. The real value of those dollars, however, is very much in doubt. As we discussed regarding inflation, the U.S. Federal Reserve determines the value of the U.S. dollar. The larger the total debt, the more incentive there is for the Federal Reserve to create money to erase those debts. Even though $3.5 trillion is a small debt for the United States, creditors have reason to fear getting repaid the full value of their debts. Where Do We Stand in the Cycle of Irrationality? What is fair value for the U.S. dollar? In the long run, countries can be neither borrowers nor lenders. Because the United States has accumulated a massive debt that will be repaid, the United States will need to run many years of current account surpluses. This change from current account deficit to surplus will be accompanied by a fall in the value of the dollar. Lets look at some major currencies in detail. Figure 6.3 shows that the dollar has already lost a lot of value against the euro.  FIGURE 6.3 The Dollar Has Lost One-Third of Its Value against the Euro Source: Federal Reserve The dollar looks to have hit an overvalued high in late 2000 and 2001. The dollar rose in value almost every day for years, and the airwaves were filled with negative comments on the euro. On October 17, 2000, Tony Norfield, currency analyst with ABN Amro said, It is simply ridiculous for people to keep suggesting the euro is fundamentally undervalued. It isnt. At the same time, Jane Foley of Barclays Capital went on record with: It is still the case that Europe needs to implement structural reforms more quickly. Until that happens and productivity improves, investors will still want to be in dollars. 12 As is so often the case in mean markets, youll note from Figure 6.3 that these experts were exactly wrong. In contrast with Mr. Norfields opinion, the euro was fundamentally undervalued, and even though Europe hasnt implemented structural reforms, Ms. Foley was wrong in predicting that investors would still want to be in dollars. Obviously the dollar was overvalued against the euro in 2000. Since then, the dollar has lost one-third of its value in euros. Is that enough? If markets were rational we might expect the decline to end when the price of products in the United States equaled those in the euro area. The Economist magazine, for example, calculates the average cost of a Big Mac hamburger in the United States to be $2.90, and the cost in the euro area to be $3.28.13 Since everyone prefers to buy Big Macs for $2.90 instead of $3.28, the theory of purchasing power parity (PPP) suggests that prices in different countries are pushed closer together. In the case of Big Macs, the dollar would have to rise in value against the euro to equalize the two prices. Thus, this burger application of PPP is saying that the dollar has fallen enough against the euro. If the Big Mac prices were indicative of all prices, particularly of goods that are actively traded, then the dollar does not need to decline any more. So the dollar might be close to fair value against the euro (there are, of course, far more comprehensive analyses of PPP beyond Big Macs). What other currencies are particularly relevant to reducing the U.S. current account deficit? Figure 6.4 shows that the dollar has lost about one-quarter of its value against a basket of major currencies.  FIGURE 6.4 The Dollar Has Lost One-Quarter of Its Value against Major Currencies Source: Federal Reserve 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 [ 45 ] 46 47 48 49 50 51 52 53 54 55 56 57 58 59 60 61 62 63 64 65 66 67 68 69 70 71 72 73 74 75 76 77 78 79 80 81 82 83 84 85 86 87 88 89 90 91 92 93 94 95 96 97 98 99 100 101 102 103 104 105 |