|

|

|

Промышленный лизинг

Методички

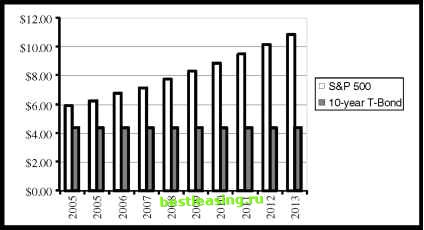

FIGURE 8.4 An Optimistic View of Stock Prices (Return on $100) Sources: Federal Reserve, Standard & Poors Stock Prices Are Not Cheap While stocks do not look terribly expensive, by most measures they are priced above historical averages and far above the valuation levels that existed at true market bottoms. So stocks appear to be either fairly valued from a current perspective, or richly valued from a historical perspective. It is hard to characterize stocks as really cheap. Growth Rate Is Crucial to Determining Stock Valuations The expected growth rate is enormously important to valuations. In the case of Microsoft, a $100 investment earns less today than the same investment in a 10-year Treasury bond. Furthermore, investors in Microsoft stock risk losing part or all of their money. To make the risk worth the reward, Microsoft earnings must rise over time to be substantially above the payoff to the ultra-safe Treasury bond. This question of earnings growth is so crucial that we will examine it further. Beyond simple valuation calculations, emotional mood swings play a major role in stock prices. In some periods, investors are willing to take risk and predict good futures. In other periods, investors are skeptical and want cash now to compensate for risk. In The Great Crash, John Kenneth Galbraith uses the word bezzle to describe an aspect of this mood swing. Bezzle is derived from embezzle, and Galbraith describes the ability of people to siphon funds out of companies and the world more generally. In good times, investors (and perhaps regulators) are optimistic and lax. Therefore the bezzle increases. In contrast, Galbraith writes, In [economic] depression, all this is reversed. Money is watched with a narrow, suspicious eye. The man who handles it is assumed to be dishonest until he proves himself otherwise. Audits are penetrating and meticulous. Commercial morality is enormously improved. The bezzle shrinks. 10 The overall pattern of optimism and pessimism is a recurring theme in investments. When everyone is optimistic about stocks, they tend to be worse investments. Doom and gloom generally predict good stock market returns. These emotions get reflected in stock prices. Consider that the S&P 500 investor today accepts about $1.81 in dividends and foregoes $4.40 in sure interest. Why accept a lower return? The lower return today is accepted because investors are optimistic about the growth of dividends. In other periods, stock investors have been so skeptical as to require that dividends exceed bond interest. In the modern market, such skepticism is reserved only for those companies that are perceived as particularly risky. For example, a $100 investment today in Altria (formerly Phillip Morris) yields $5.50 in dividends.11 An investor earns more today from Altria dividends than from the interest on a 10-year Treasury bond. Because investors fear that smoking-related lawsuits might bankrupt Altria, they price the stock so that they are paid to take risk. While this skepticism exists for Altria, for the market as a whole, investors are willing to accept lower dividends. Currently, optimistic investors accept low dividend yields in the hopes of future gains. Even without any change in stock market fundamentals, any move that clamps down the bezzle and general optimism would be reflected in lower stock prices. Where do we stand on stock valuations? Based on the Fed model that compares stocks to 10-year Treasury bonds, stocks appear to be reasonably valued. Based purely on the Fed model, optimists can buy in the hopes of strong profit growth and pessimists can sell on the expectation of profit disappointments and interest rate rises. Beyond the Fed model, however, valuations are dependent on growth rates and emotional swings. Natural Limits to Earnings Growth Some years ago, I watched Arnold Schwarzenegger being interviewed about the appeal of bodybuilding. He was asked, why are some people obsessed with physical size? Arnold replied, You dont go to the zoo to see the mice. His claim was that humans are naturally built to care about size. (In Pumping Iron Arnold seeks to make his opponent Lou Ferrigno feel bad about himself. Accordingly, he hits Lou with the worst insult possible to a bodybuilder, Lou, youre looking very small today. ) Stock market pundits are obsessed not only with the size of corporate profits, but also with their growth rate. You can imagine investors in fast-growing companies making Arnold-like comments of, You dont buy stocks for their book value. The obsession with growth is appropriate given the fact that stocks are risky and pay less today than safe Treasury bonds. The main reason to accept the risk of stock market losses is the promise of a growing profit stream. Thus, investors are correctly obsessed with growth. What are the prospects for corporate profits growth? Here, there is a clear answer. It is that profit growth, and consequently stock prices, cannot continue their historical performance. Before getting to the reasoning for the limits on profit growth, it is nice to point out that this is one of the few questions that have an unambiguous answer within the investing world. This rarity of clarity is the subject of an entire subset of the jokes about economics (also known as the dismal science ). For example, if you laid all the economists in the world end to end they still wouldnt reach a conclusion. Or, more cruelly, if you 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53 54 55 56 57 58 59 [ 60 ] 61 62 63 64 65 66 67 68 69 70 71 72 73 74 75 76 77 78 79 80 81 82 83 84 85 86 87 88 89 90 91 92 93 94 95 96 97 98 99 100 101 102 103 104 105 |