|

|

|

Промышленный лизинг

Методички

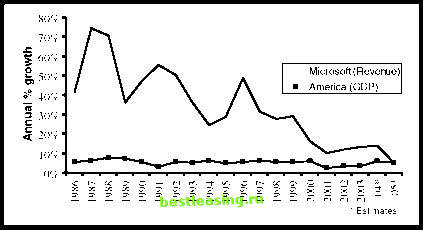

laid all the economists in the world end to end that would be a good thing. To counter this, lets make the clear statement and then explain the reasoning. Fact: Corporate profits have been growing above their natural speed limit for a long time. The future for stocks cannot be as bright as the past. On the road to this conclusion we start at the basics-with bacteria. Almost every biology textbook contains a section that describes bacterial growth rates in terms of something like this: Some bacteria can divide every two hours. If this replication pace were sustained for several weeks, the offspring of one bacterium would weigh more than the universe. Continuing our Arnold theme, bacteria could mock Internet companies by saying, Yahoo!, youre growing very slowly today. Left unconstrained, one bacterium would become 4,096 in one day, over 16 million in two days, over 60 billion in 3 days, and enough to weigh more than the earth in a couple of weeks. So bacteria can grow really fast. Over the long run, what has been the growth rate of bacteria? The surprising answer: zero. Bacteria have been around for a really long time. Doing the simple mathematical calculation of the annual growth rate over their history, bacterial growth rates are infinitesimally greater than zero. An unavoidable mathematical law causes the contrast between doubling every two hours and a long-term growth rate of zero. At least for the last several billion years, the earth itself has not changed significantly in weight. The long-run rate of growth of the earth has therefore been zero. Thus, anything that is a subset of the earth, including bacteria, must have a long-run growth rate of no more than zero. This is a mathematical truism. A part of a system cannot sustain a higher growth rate than the system for an indefinite time. Just as bacteria are part of the earth, any single company is part of the global economy. Thus, over the long run, no company can grow faster than the worlds economy. For example, Figure 8.5 shows the growth in  FIGURE 8.5 Microsofts Growth Rate Has Slowed toward That of the U.S. Economy Sources: Microsoft, U.S. Department of Commerce, Congressional Budget Office Microsofts revenues from its public debut until today as compared with the growth of the U.S. economy. (The best graph would use global economy growth; the chart uses the United States because the story is the same and the U.S. statistics are more reliable.) When Microsoft was a young company, its growth rate was spectacular. Over the years, however, that growth rate has slowed and now is much closer to that of the entire country. Over the long run Microsoft cannot grow faster than the economy. In fact, the gap is projected to disappear in 2005 (Figure 8.5).12 Whenever a company, or a set of companies, is growing faster than the economy, that growth rate is unsustainable. The relevant question is not if growth will slow to the natural speed limit but when growth will slow. Both corporate revenue and profits are subject to the same natural speed limit. Neither revenue nor profits can grow faster than the economy indefinitely. Figure 8.6 shows, however, that U.S. corporate profits have been growing faster than the economy.

FIGURE 8.6 Profits Have Grown More Than the Economy Sources: Bureau of Economic Analysis, U.S. Dept. of Commerce, Congressional Budget Office Looking at the data from the same period as the Microsoft chart, U.S. corporate profits grew faster than the economy. This growth in profits- that is above the natural speed limit-is unsustainable. While there is no obvious time for this above-average growth to end, it must eventually end. The logic is as inescapable as death and taxes. Buying the Hype at Precisely the Wrong Time Profits of U.S. firms have been growing faster than the economy. What does this imply for stock prices? When something is doing better than average, it probably pays to be a bit cautious. If an athlete, for example, has a fantastic year, it would be prudent to expect the next year to be less fantastic. As investors, it seems that we are built to feel exactly the opposite. We tend to overweight recent events. This leads us to be most optimistic at exactly the wrong time. Consider the case of Sun Microsystems. In the 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53 54 55 56 57 58 59 60 [ 61 ] 62 63 64 65 66 67 68 69 70 71 72 73 74 75 76 77 78 79 80 81 82 83 84 85 86 87 88 89 90 91 92 93 94 95 96 97 98 99 100 101 102 103 104 105 |

||||||||||||||||||||||||