|

|

|

Промышленный лизинг

Методички

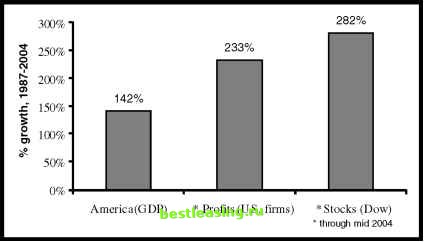

late 1990s Sun was riding a boom caused by Y2K and the Internet bubble. Suns revenues and profits were shooting up at rates approaching 100% a year.13 What should a rational investor have done when evaluating Suns performance in the late 1990s? The answer is that, rationally, 100% growth rates are unsustainable. Thus, a prudent investor would have given a lower weight to Suns current performance. Historically, investors have priced stocks at somewhere between 10 and 20 times a firms current profits. Prudence in the late 1990s might have argued that Sun deserved something toward the low end of this range. Did investors realize that Suns performance in the late 1990s was unsustainable? Quite to the contrary, their lizard brains caused them to bid Suns price stock up until they were paying close to 100 times current earnings! Precisely at the moment when Suns profits were growing at the most unsustainable pace, investors valued those profits at the highest level. The result was financial devastation for Sun shareholders as the stock lost more than 90% of its value.14 Figure 8.7 suggests a potential problem for stock prices. It shows that stock prices have risen even more than corporate profits in the years since 1987. The diagram takes the most conservative estimate of stock market appreciation. As a starting point, it takes the highest level of the Dow Jones Industrial Average before the 1987 crash.15 Any other starting point would yield an even higher growth rate. Furthermore, the calculation ignores dividends, which would again serve to dramatically increase stock market returns. We end up with two layers of unsustainable growth. Corporate profits are growing at an unsustainable pace relative to the economy, and the stock markets valuation of those profits is growing even faster. If profit growth is going to slow toward its natural limit, then current profits might be reasonably valued at prudent multiples. Quite to the contrary, investors have bid up stock prices so that they are paying more now for every dollar of profits than before.  FIGURE 8.7 Stock Prices Have Risen Even More Than Profits Sources: Bureau of Economic Analysis, U.S. Dept. of Commerce, Congressional Budget Office When will corporate profits and stock prices slow down to their natural speed limit? I was pondering this one night while watching a Tonight Show visit by Phil McGraw ( Dr. Phil ) who was promoting his book The Ultimate Weight Solution. Jay Leno was making fun of the authors weight, and Dr. Phil responded by saying, Are you saying Im too fat to write a diet book? Leno responded by saying that he wouldnt be making the joke except that the title of the book is the ultimate weight loss solution. Less extreme adjectives, Leno suggested, would have been more appropriate for a man of Dr. Phils size. Presumably, a pretty good weight loss solution or moderate weight loss for fatties would not have drawn Lenos wit. Professor Siegel does not make a similar mistake in his work promoting stocks. His book is called the Stocks for the Long Run, not Stocks for the Super, Super Long Run or Jurassic Investing Secrets. Over the truly long run, Professor Siegels argument cannot be right. Stocks cannot be the ultimate investment because over the long run, they can only be average. No one knows when the natural speed limit will hit corporate profits and stock prices. John Maynard Keynes famously quipped, In the long run we are all dead. His point is that arguments about the truly long run have little meaning to people whose horizons stretch out just a few years. Just as Microsoft grew very rapidly for more than a decade, there is no reason to expect an imminent slowdown in the growth of stock prices. Nevertheless, such a slowdown is inevitable. Buying Stocks with the Wall Street Bulls Our fundamental analysis so far has made two conclusions. With current profit projections and interest rates, stock prices look to be close to fairly valued. There is some hint of trouble in the fact that both profits and the valuation of the profits are increasing at unsustainable rates. The next piece of the valuation puzzle is an attempt to gauge investors moods. The universal investing rule is that popular investments are unprofitable and vice versa. Where do we stand in the cycle of excessive optimism and pessimism toward stock ownership? We can look at Wall Street gurus for clues. The big financial firms employ market strategists who make both predictions and investment recommendations. Richard Bernstein is one such strategist who works for Merrill Lynch & Co. In 2003, Mr. Bernstein was criticized for being too negative on stocks.16 Bernstein fretted about a number of problems including the U.S. trade deficit and the possibility of rising interest rates. Compared to his brethren Mr. Bernstein has been quite negative on U.S. stocks for years. In 2003, however, stocks prices soared. Investors who listened to Mr. Bernstein made less money than if they had listened to his competitors. Not surprisingly, Mr. Bernstein was under fire for his ursine outlook. How bearish was Mr. Bernstein? The amazing fact is that for all his bearishness Mr. Bernstein suggested that people invest almost half their total financial wealth in the risky stock market. How can this be 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53 54 55 56 57 58 59 60 61 [ 62 ] 63 64 65 66 67 68 69 70 71 72 73 74 75 76 77 78 79 80 81 82 83 84 85 86 87 88 89 90 91 92 93 94 95 96 97 98 99 100 101 102 103 104 105 |