|

|

|

Промышленный лизинг

Методички

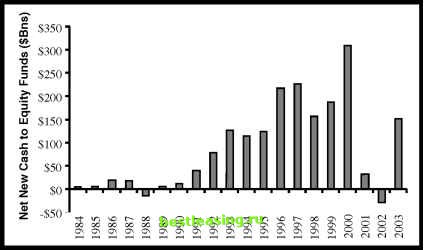

into stocks, it is extremely tough to kick the habit. The argument against being completely bullish on U.S. stocks is an argument of cognition against experience. My lizard brain still tells me to invest everything in stocks even though my analyses suggest otherwise. With my rational side, I am able to control my investments, but I cant stop my lizard brain from loving stocks. Love affairs, whether of the wallet or the heart, share common elements. In Shakespeare in Love the young playwright falls in love with cross-dressing Viola de Lesseps (played by Gwyneth Paltrow in her Academy-Award-winning role). Along their romantic road to an eventual happy ending, Shakespeare and his love must endure a set of challenges, including a very public engagement between Viola and Phillip Henslowe (played by Geoffrey Rush). Because Violas fiance is a lord, the whole gang ends up before Queen Elizabeth. Another lord in the audience asks the Queen how the story will end. She replies, As stories must when loves denied: with tears and a journey. While we have had some tears in our love affair with stocks, Figure 8.8 shows that there has been no journey away from stocks. Over the 10 years spanning 1994 to 2003, investors have placed an additional $1.5 trillion in long-term equity mutual funds. In the post-bubble world, the rhetoric surrounding stocks is somewhat tempered but there has been no movement away from stocks as an investment class. Before stocks represent outstanding value, I predict there will be many years during which investors are taking money out of stocks. It is the 1998 edition of Professor Siegels Stocks for the Long Run, that proclaims, Stocks are actually safer than bank deposits! Of course, two years after this edition was published, the S&P 500 lost half its value, and the NASDAQ lost 70% of its value. In the post-bubble, 2002 edition of Stocks for the Long Run the dust-jacket promotion of stocks being safer than bank deposits has been removed. Nevertheless, the message remains the same. In fact, Professor Siegels advice on investment allo-  FIGURE 8.8 Americas Love Affair with Stocks Is Not Over Source: Investment Company Institute, 2004 Fact Book, Table 13 cation is worded identically in both pre- and post-bubble editions, Stocks should constitute the overwhelming proportion of all long-term financial portfolios. 19 Stocks for the long run is still the conventional wisdom. In their 2004 retirement planner, The Motley Fool website says, Fools opt for stocks above all else as our vehicle of choice for growth over the long term. (Devotees of the Motley Fool call themselves fools as a compliment.) Weve seen that Wall Street still recommends that about two-thirds of all investments should be in stocks. Furthermore, Americans own historically high levels of stocks. In a Shakespearean sense, weve had the tears of a bear market, but we have not had the voyage away from stocks that generally marks the end of an investment era. U.S. stocks are still the most loved of all investments. If the most loved investment proves to be the most profitable, it will be the first time in investing history. I conclude, in answer to Peter Borishs question, that buying stocks is indeed driving the financial car by looking in the rearview mirror. I still recommend a significant investment in stocks, not because I expect them to have higher returns than all other investments, but because stocks have tax advantages and generally unrecognized advantages as risk reducers. While I advocate a substantial investment in stocks, I am far more sanguine about their prospects than Professor Siegel or Wall Street. 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53 54 55 56 57 58 59 60 61 62 63 64 [ 65 ] 66 67 68 69 70 71 72 73 74 75 76 77 78 79 80 81 82 83 84 85 86 87 88 89 90 91 92 93 94 95 96 97 98 99 100 101 102 103 104 105 |