|

|

|

Промышленный лизинг

Методички

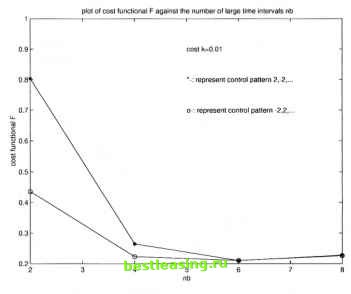

Figure 3.3. Plot of cost function F against the number of large time intervals nb As discussed earlier, two different levels of the subdivision of the time intervals are used in this example. But the control policy is only constructed so that the control switches at the end of the large subintervals. In two experiments shown in Figure 3.3, a cost к - 0.01 attached to nb (the number of the large subintervals) is added to the objective function. It is known that a greater number of subintervals lead the system to a more accurate minimization. A more accurate value of the objective function can be obtained when The cost is attached to the results of the objective function at ns = 64. Two different lines in Figure 3.3 represent the results of the two different patterns of the control which are shown in Figure 3.1 and Figure 3.2. At point nb = 6, both of them reach the optimum. It is confirmed that the financial system with two different control patterns will reach the same minimum with the same cost when the number nb of subdivisions increases. Since there are some non-switching times obtained from the computation, it is conjectured that whether an optimal control with a zero value in the middle to match the non-switching times can bring a better approximation. An example with this matching control will be discussed in Chapter 5. 7. Financial Investment Implications and Conclusion Since the financial sector is volatile, a financial oscillator model is necessary to study the non-linear complex dynamic behavior of the sector. Incorporation of a damping function to stabilize the oscillatory dynamics of the financial sector can facilitate an understanding of the control mechanism useful for smooth functioning of the financial market. The modeling and computational experiments in this chapter show similar results as those obtained in Chapter 2. Switching times and costs of switching control are significant factors in the determination of optimal investment planning strategy for the economy. Higher costs of switching control reduce the optimal number of switching times essential in evolving an optimal investment strategy overtime. The dampening factor is also significant in designing stable optimal investment planning. This page intentionally left blank 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 [ 30 ] 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53 54 55 56 57 58 59 60 61 62 63 64 65 66 67 |